Already have an Employee Insurance Benefit Plan?

We'll contact you 2 months prior to your renewal date. We'll make sure your price is great for the kind of plan you have.

Tell us your renewal month.

Renewal Notice - Home 1

"Your profitability is not about how much you make, but about how much you keep.”

Your employee benefit costs are an expense. And it’s an expense that you should have some control over. STOP letting the insurance company drastically increase your renewal rates. It’s time for you to take back control of what you spend, so you can keep more of what you earn.

The Top 3 Mistakes Business Owners Make with their Employee Benefit Plan

Mistake #1

Not Understanding Plan Structure

They do not think about their plan structure and the impact of their claims. Some group insurance plans are "Experienced-Rated" and some are pooled.

Mistake #2

Rushing Plan Design

Your claims are influenced by your plan design. Carefully select your plan design, control your claims, & control your renewal.

Mistake #3

Ignoring Eligibility Criteria

Which particular class of employees qualify for benefits & what does that class look like?

I already have an advisor. Are all advisors the same?

Imagine being accused of a crime. You have to select your lawyer. The right lawyer can make the difference between life free or life in prison. Would you quickly select your lawyer?

Your group insurance advisor should be selected with the same consideration. The right advisor could make the difference between a stable renewal and high renewal. The right advisor can make the difference between keeping your plan for the long term, or cancelling it shortly after implementing it.

How could I know if my advisor is giving me the right advice?

Did your advisor go to market, quote half a dozen different insurance companies, and recommend the cheapest solution?

If so, RUN!

Short-term savings more often mean higher renewal rates. There are many insurance companies that want your business. And they’re willing to discount your rates to earn it. But once you’re a customer, the only thing that matters is your claims.

Here’s the million dollar question to ask your advisor:

“What strategies have you implemented to give me the best shot possible at a sustainable renewal?

Here’s a True Story – And the beginning of our story.

Don’t let this experience become your true story.

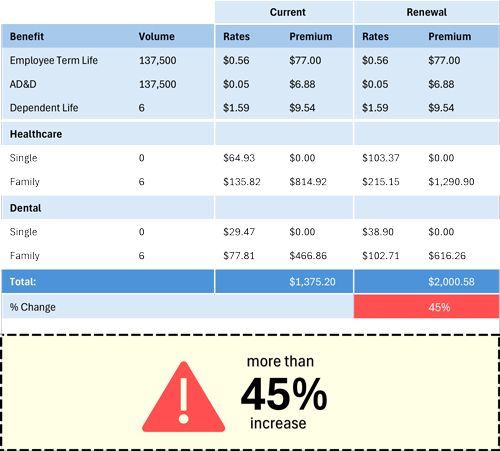

We met a small company with 6 employees. It was a small and ordinary manufacturing firm. The business owner implemented benefits as an incentive to reward his long term employees. Within that same year, an employee lost a finger on the job.

That employee used:

1: the ambulance service to get to the hospital.

2: the semi-private hospital room in hospital.

3: regular prescriptions for pain killers.

4: regular physio for recovery.

Also, it was their first year with benefits so of course, everyone got their teeth cleaned. They also renewed their prescription glasses. Of course, at their first renewal, the insurance company proposed a 45% increase in rates. This unfortunate business owner was forced to decide between paying a substantial increase or cancelling benefits.

Could this increase have been avoided? ABSOLUTELY.

Don’t let this be your story...

It was at this moment, our story began.

We no longer wanted to see business owners who lead their team by making positive changes, and then are punished for circumstances beyond their control. We became angry at seeing the large insurance companies push around the small business owner because they happened to need the coverage at the time they had coverage.

Our focus is to develop plans that are sustainable, manageable and affordable. Not just this year but for all future years to come.

Don't commit to a long-term plan, if you don't know how to do long-term planning.

Giving employees benefits is not a short term commitment. Business owners often make commitments in their employment agreement and benefits become a part of an employees compensation package.

Imagine building a business and not knowing what next year's price will look like. How can you properly forecast growth? Your benefit plan deserves expert advice. You need to get ahead of your renewal.

Don't wait until your renewal to ask, "my price went up, what should we do" - it'll be too late, the claims already hit the system.

Your Advisor’s Kryptonite!

You have two relationships.

When you have an employee insurance benefit plan, you have two relationships.

- Is with your insurance company. They handle the coverage and the billing.

- Is with your

advisor. They support you with strategy and in aligning you with the right carrier and price.

What if you're unhappy with your advisor?

You have the power to:

- Keep your insurance company, your plan, and your rates.

- Change your advisor.

An

Agent of Record (AOR) letter acts as your advisor’s kryptonite as you can use it to replace your advisor any time for FREE.

Why replace your advisor?

- Maybe it's been several years since you've heard from them & they've become MIA.

- You’re unsatisfied with the service you’re receiving.

- You’re just looking for different advice because your renewals have been frequently high.

If you’d like us to be your advisor, download our AOR.

FAQs

Why do we prioritize 10 to 25 employees?

Heros come in many shapes and sizes. Business Owners who reward their employees with benefits are Heros. But even heroes need sidekicks.

Business owners with 10-25 employees likely already have a benefit plan in place. And if you’re like most business owners, you’re probably struggling with your renewal. We are expert sidekicks at helping Heros keep their plan sustainable.

We love delivering sustainable renewals. To achieve this, it requires strategic planning and forward thinking. In other words, we’re looking for Heros that already have a plan and need expert advice in keeping their plan manageable.

Will we service companies that are less than 10 employees?

It’s not profitable for us to service customers with less than 10 employees – because of all the work we do. However, number one core value is “Hearts Before Profits”. If you’re a company with less than 10 employees and your core values align with ours, then we’d love to help you.

Will we service companies more that 25 employees?

The kind of work we do is most appreciated when we’re working with people who care. Not many people will care more about the business than the business owner themselves. When we work with companies that have more than 25 employees, we’re often assigned to work with an employee who just wants quotes on a spreadsheet and wants to move on with their day. Our value comes from the advice we deliver. Our value comes from years of delivering sustainable renewals. If you’re a company with more than 25 employees and you’re willing to put in the time to work with us, then yes, we’ll work with you too even if you have more than 25 employees.

I already have an advisor / My advisor can already go to market / Are all advisors the same?

Not all advisors specialize in Group Employee Benefit Plans. That’s all that we do. Saying all advisors are the same is like saying “all accountants are the same”, or “all lawyers are the same”. Really? Your advisor’s job is not to get you quotes. It doesn’t take much effort to collect a quote from an insurance company. In fact, most advisors even outsource that responsibility to another firm called a Group MGA. Your advisor’s job is to give you advice that will help you achieve your goals. Selecting the plan – delivering it to the right class – keeping the renewal sustainable – decreasing your turnover – supporting you with employee retention – keeping you competitive. You need a good advisor for this.

How do I know if my advisor is a good advisor?

If your advisor delivered quotes in a side-by-side chart and recommended the cheapest solution, you might want to get a second opinion.

First, your advisor needs to get a good grasp of your goals. Attracting employees and retaining employees are common goals for business owners. Your advisor needs to take the time to understand what kind of employees you have. How competitive is your plan. And your plan should be designed to support you in achieving your goals.

Most importantly, your advisor needs to be forward thinking. Needs to know what kind of impact the decisions you’re making today will have at renewal.

You must ask your advisor. “What strategies have you implemented that will support me in achieving a sustainable renewal”.

Already have an Employee Insurance Benefit Plan?

We'll contact you 2 months prior to your renewal date. We'll make sure your price is great for the kind of plan you have.